Q1 2025 Supply Chain Report

January 1, 2025

Happy 2025!

We hope you had a very Happy Holidays full of family, friendship and love. We are looking forward to another exceptional year with you.

While most sentiments are very positive for the electronics industry in 2025, there are areas of caution centered around the changing of the US administration later this month. The US government’s policies over the past few years have significantly strengthened the US’ global position in the electronics industry, and we are hoping that President-elect Trump will continue the necessary investment to make the US successful. While signs point to him focusing on strengthening American manufacturing, the biggest concern is related to tariffs.

Section I: TAriffs and export restrictions

Since Tariffs are a top topic for most people in the industry these days, we will begin with this topic.

On January 1, President Biden’s tariff increase on semiconductors manufactured in China from 25% to 50% went into effect. While this will significantly impact on the industry as a whole, the good news is that it should not significantly affect our customers. Over the past several years since the first tariffs were announced, semiconductor manufacturers have focused on diversifying manufacturing sites to minimize impact to the US-based customers. We analyzed all parts currently purchased by Microboard, and almost all of the affected parts are low cost components such as diodes, transistors and LED’s. We have already contacted customers about the most significant effects of this legislation. As new demand for different assemblies is added by customers, there could be significant impacts on those components.

This follows earlier restrictions Biden placed on exports of certain higher technology semiconductors, primarily used in defense and security applications, as well as certain semiconductor manufacturing equipment imports into China.

China has responded by banning exports to the United States of precious minerals gallium, germanium and antimony, which are widely used in defense component applications. Initial estimates are that this could potentially impact approximately 700,000 electronic components produced by over 1000 manufacturers. The US is estimated to import 95% of gallium, 80% of germanium and 85% of Antimony from China, which is by far the leading source of gallium and germanium. Russia is the leading producer of Antimony. To prevent significant shortages or component redesigns, negotiations between the two countries must happen quickly.

President-Elect Trump has said that he will add an additional 10% on all products coming from China on day 1 of his presidency, along with 25% tariffs on all products coming from Mexico and Canada. This could be significant for our industry as they supply the US with large amounts of oil, metals, plastics, precious minerals and manufacturing equipment. The list of items imported from these countries is much longer than this list, but for purposes here, we are focusing just on what will affect our industry.

Trump has further threatened 100% tariffs on imports from BRICS (Brazil, Russia, India, China and South Africa, as well as others that have since joined or are considering to join) countries if they are to change from the US dollar as standard currency. This will certainly have a significant effect on semiconductor supply. He has more recently threatened tariffs on the European Union as well.

Digging further into this, threats of tariffs could significantly slow investment. Companies have been focusing on moving US-bound product manufacturing out of China for several years. Much of this investment has gone into Mexico or SE Asia. However, with the threat of tariffs going into these territories, companies may hesitate to proceed with further investment until there is greater certainty on what the tariffs will entail. Trump’s stated goal is to continue to “Buy American”, but many companies and industries are already struggling to find workers to meet demand, and manufacturing costs in the US are still significantly higher than in other countries on many commodities.

While we will not know how many of these tariffs he will implement for at least a few more weeks, negotiations will hopefully take place to ensure the continued strength of the global economy.

Section II: Electronica

Moving on to more positive news, Nicole, Bryan Brady and I had the opportunity to attend Electronica in Munich, Germany in November. This event, held every 2 years, is the world’s largest exhibition for the electronics industry. There were over 2700 exhibitors and 80,000 attendees.

We had the opportunity to meet with executives from all of our key distributors and several manufacturers. We also built on an already strong partnership with Accuris (formerly IHS), and will be closely working together with them to grow their future product offerings such as the ability to identify tariff information and component composition. We met with our new partner CalcuQuote, which will enable us to significantly improve the mechanics of our quoting process. And we got to meet many old and new friends from all over the world.

The overall mood of the event was extremely positive compared to previous years. Excess inventory is still a concern, but nearly everyone feels confident that the industry is headed in the right direction. We are already looking forward to 2026!

Section IIi: Ems industry

Overall, the industry remains mostly bullish for 2025, with tariffs and labor costs listed as the biggest concerns. The first half may be somewhat tepid, as companies burn off the remaining excess inventory in the supply chain and wait to hear the upcoming tariff data, but all signs point to a very solid 2nd half of the year.

The US EMS industry has continued to grow solidly, with shipments up 14.7% year-on-year in October and 10.6% in November. We expect to see this continue through most of 2025, especially with declining interest rates, which should spur further investment. Beyond 2025 is heavily dependent on a number of unknown circumstances including the global economy, incoming administration and budget, and worldwide economic impact.

Asia Pacific also looks to be in strong recovery mode, with Europe appearing to be relatively flat.

We see a continued “nationalization” trend with countries like Canada, Vietnam and Japan all sharing plans on how they will become more reliant on their own electronics supply chains.

Green initiatives are also being closely watched. Europe is expected to continue to become more focused on sustainability, while the incoming Trump administration is expected to significantly backtrack on much of work done by the Biden administration for the US.

Semiconductors

We expect significant evolution over the coming years in the semiconductor market towards regionalization, balancing technology with resilience and overcoming geopolitical concerns of supply, government influence over competition and raw material availability for trade.

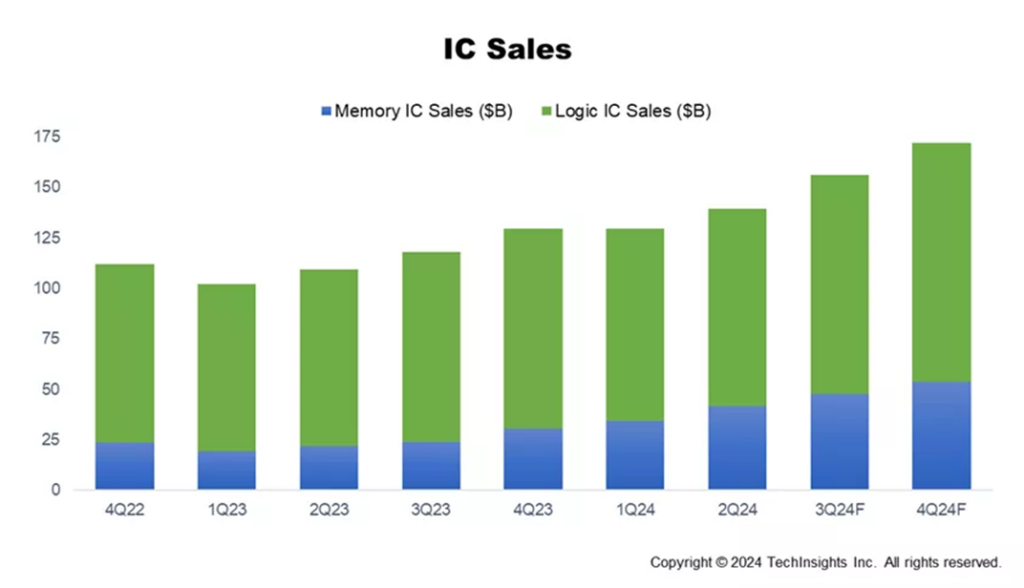

The semiconductor market has continued to grow dramatically, largely driven by AI applications. Expectations are that it will grow between 11% and 15% in 2025. Memory is expected to grow by 24% in 2025.

Spending through the CHIPS Act has started to yield results with the first factories already opening. TSMC, the world’s largest wafer fab manufacturer, has stated that initial yields from its newly opened Arizona fab already exceed those of its other factories in Taiwan and China. TSMC continues to gain global market share, growing from 59% in 2023 to 64% in 2024, and is expected to be at 66% in 2025. As they are Taiwan based, they have been strategically opening locations around the globe to de-risk any potential hostile actions from China.

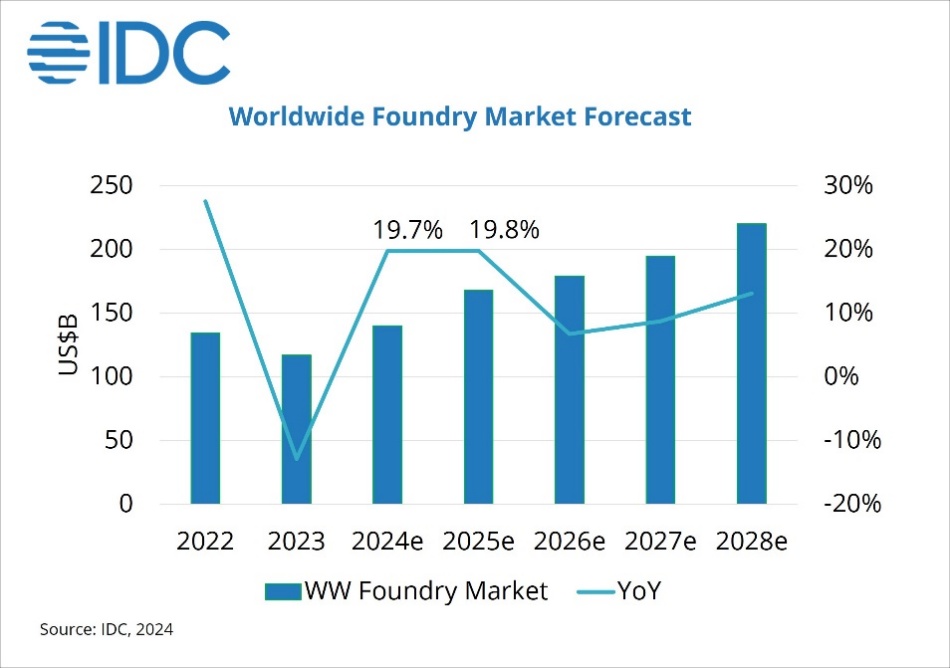

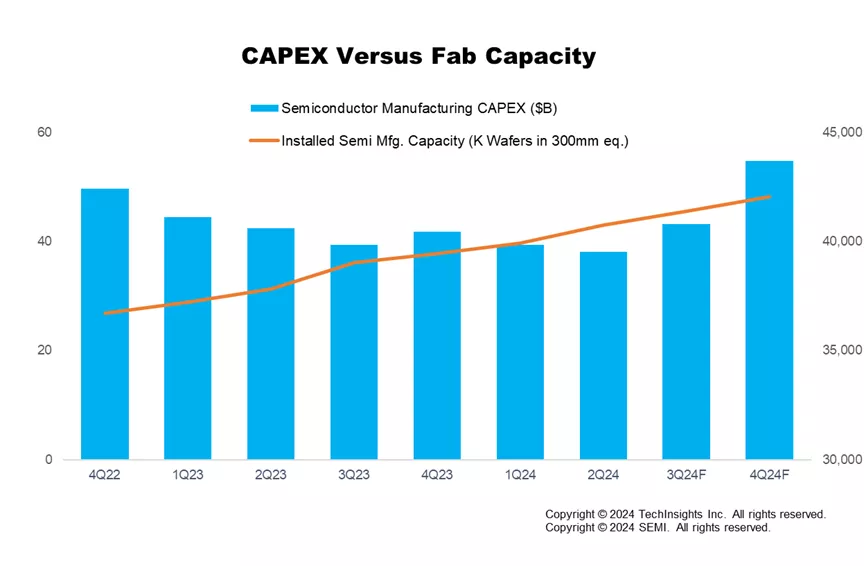

Capacity at the foundry level grew by nearly 20% in 2024 and is expected to grow at the same rate in 2025. Capital investment is expected to increase by 11% in 2025. According to Semiconductor Manufacturing Monitor (SMM), worldwide silicon wafer shipments increased 6% in Q3.

Even with the significant expansion we are seeing in the Americas, China still consumes 50% of the world’s semiconductors, while the US consumes roughly 25%.

One key concern from about three months ago that seems to have resolved itself is the potential quartz shortage. Hurricane Helene struck Spruce Pine, NC, which has the world’s only pure source of quartz. Fortunately, as of October, the 2 main mining companies in the area, Quartz Corp and Sibelco, are both operating again.

Lead times are starting to expand again in several commodities, so it is critical that our customers share 9 to 12 months of forecast or PO. Power Discretes especially are stretching up to 9 months in some cases.

Passives

2024 was a soft year for passives. The oversupply of inventory has remained for roughly a year longer than originally forecast. According to those we talked to at Electronica and other sources, it appears that the “rock bottom” has finally hit, with many suppliers returning to growth.

Multi Layer Ceramic Capacitors (MLCC’s) are expected to return to double digit growth in 2025, with most other passive commodities expected to grow in the single digits. Growth is expected to be slower in the first half of 2025 with a strong finish.

Lead times for most products are projected to remain flat, although larger case sizes are extending in some cases.

PCBs

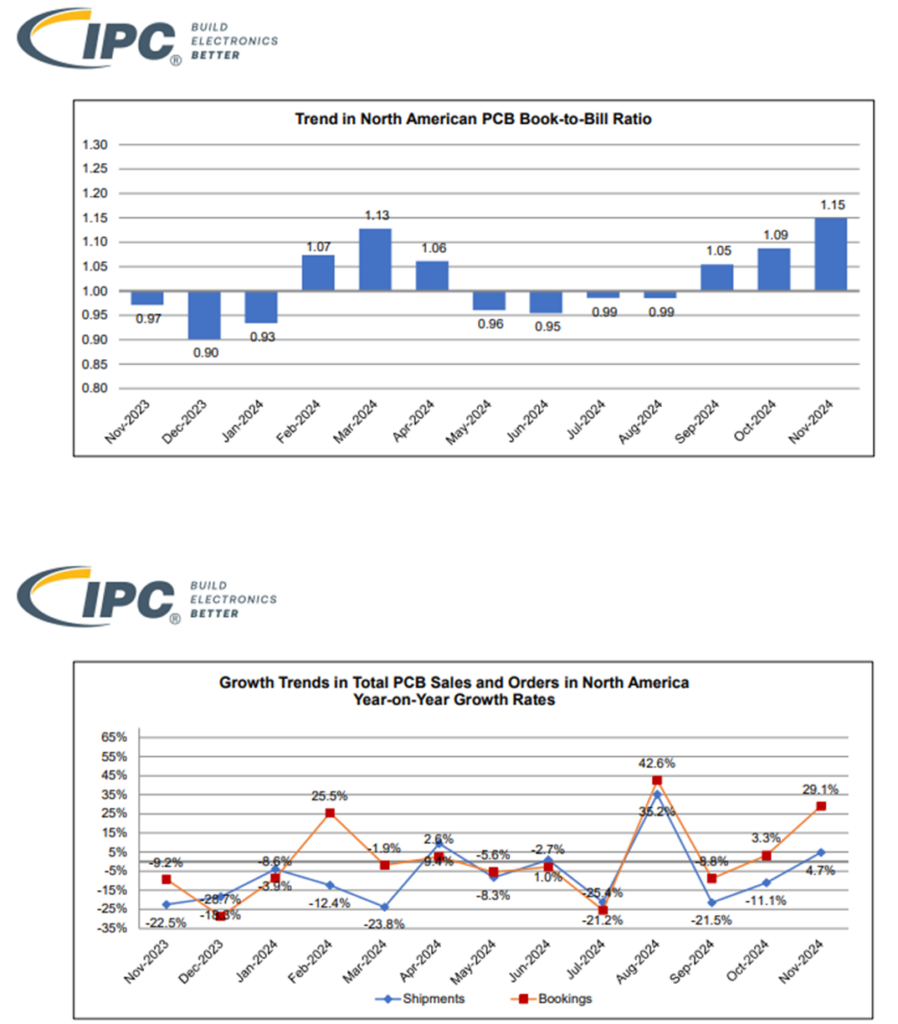

North American PCB sales continued to struggle to grow, with November up slightly by 4.7% after October showing an 11.1% year-on-year contraction. The Aerospace & Defense Sector has remained strong, with other sectors showing continued weakness.

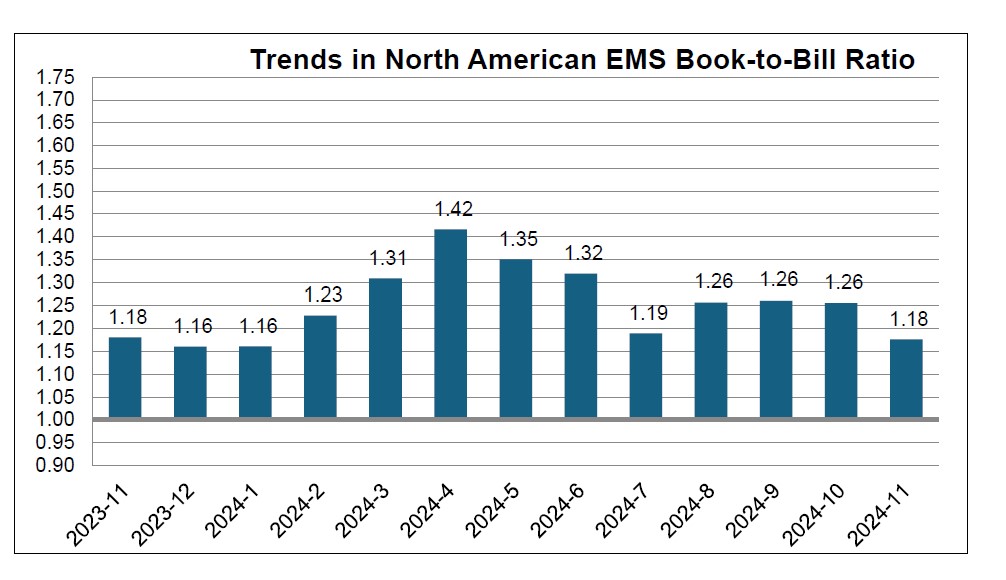

Fortunately, the Book-to-Bill ratio has been positive for 3 consecutive months, showing strong signs of a recovery in 2025.

We have seen lead times start to come down in several factories, although a return to normalcy is still not yet in sight. Many companies are investing in automation and expansion to continue to meet the constantly increasing technology requirements in the A&D sector. TTM, having received a $30 million grant from the US Government has broken ground on what will be the largest PCB and substrate facility in the US in Syracuse, NY. Other companies continue to invest in Southern California, where there is a large concentration of engineering talent. However, they must overcome a shortage of hourly workers and high labor costs.

Only a few decades ago, the US produced approximately 30% of all PCB’s manufactured worldwide. Today the number is approximately 4%. China builds roughly 58%. Nippon Denkai USA just decided to close the last remaining copper foil plant in the USA. It is critical that the US focus on rebuilding PCB manufacturing and its supply chain.

- The proposed tariffs from Trump could increase costs from China, Europe and Canada…and potentially other countries by 10% to 25% or more.

- Demand returning to near normal levels in APAC will most likely increase prices to reasonable margins from that region vs. the “fire sale” pricing we have recently seen.

- The PCB Association of America (PCBAA), of which Microboard is an active member, is lobbying Congress for a 25% tax credit for boards built in the US. Microboard recently hosted , Executive Director of PCBAA at our facility, and are committed to supporting them on efforts to rebuild this critical industry in the US. If your company is interested in joining this organization or learning more about it, please let me know so that we can make an introduction.

Microboard has audited TTM facilities in Santa Ana, CA and Logan, UT and APCT facilities in Anaheim, CA and Chandler, AZ in the past quarter. We plan on doing several more audits this quarter, focusing in the Toronto area and the eastern US. We are reaching out to other suppliers and sites we have traditionally not worked with in the past, in order to diversify and de-risk Microboard’s spend. We want to ensure we have the right relationships, and are choosing the right suppliers to ensure on time, high-quality boards at all times

Interconnect

Lead times are mostly flat to up, with circular and backplane connectors extending.

Molex has announced that they will acquire Airborn to increase its penetration into the Aerospace & Defense Market.

We have seen significant price increases from Corning for multiple customers.

Scheduling Agreements

Section iv: conclusion

As always, we thank you for choosing Microboard. We will continue to offer the best in technology, quality, supply chain, and service, and we trust that you see the value in our offerings.

We hope you are enjoying this newsletter. Feedback on what we can do to make it more interesting is always welcomed.

Wishing you the best in 2025!

Wayne Ellis

Vice President of Supply Chain

wellis@microboard.com

M: +1.330.360.2514

About Wayne:

Wayne Ellis is the Vice President of Supply at Microboard, with 35 years of supply chain experience, including 25 years in the EMS industry. He leads Microboard’s Strategic Sourcing, Procurement, and Master Scheduling. Before Microboard, Wayne held leadership roles at SVI Electronics, IEC Electronics, Mack Technologies, and Jabil. He holds a Bachelor of Science in Business Administration from Bowling Green State University and has completed postgraduate coursework at the University of San Diego.